Can I change my car before the end of my finance contract?

This a question we are frequently asked at Evans Halshaw. Whether people are looking to simply upgrade their car or circumstances have led them to require a larger or more practical vehicle; you’ll be pleased to hear the answer to the question is yes.

It doesn’t matter whether you have a car on Hire Purchase (HP) or Personal Contract Purchase (PCP), the process is simple.

You are watching: Can A Finance Car Take Back A Direct Deposit

How do I change my car before the end of my finance agreement?

Step one: get a finance settlement figure

Firstly you’ll need to get a finance settlement figure from your lender and ensure the V5 certificate is in your name.

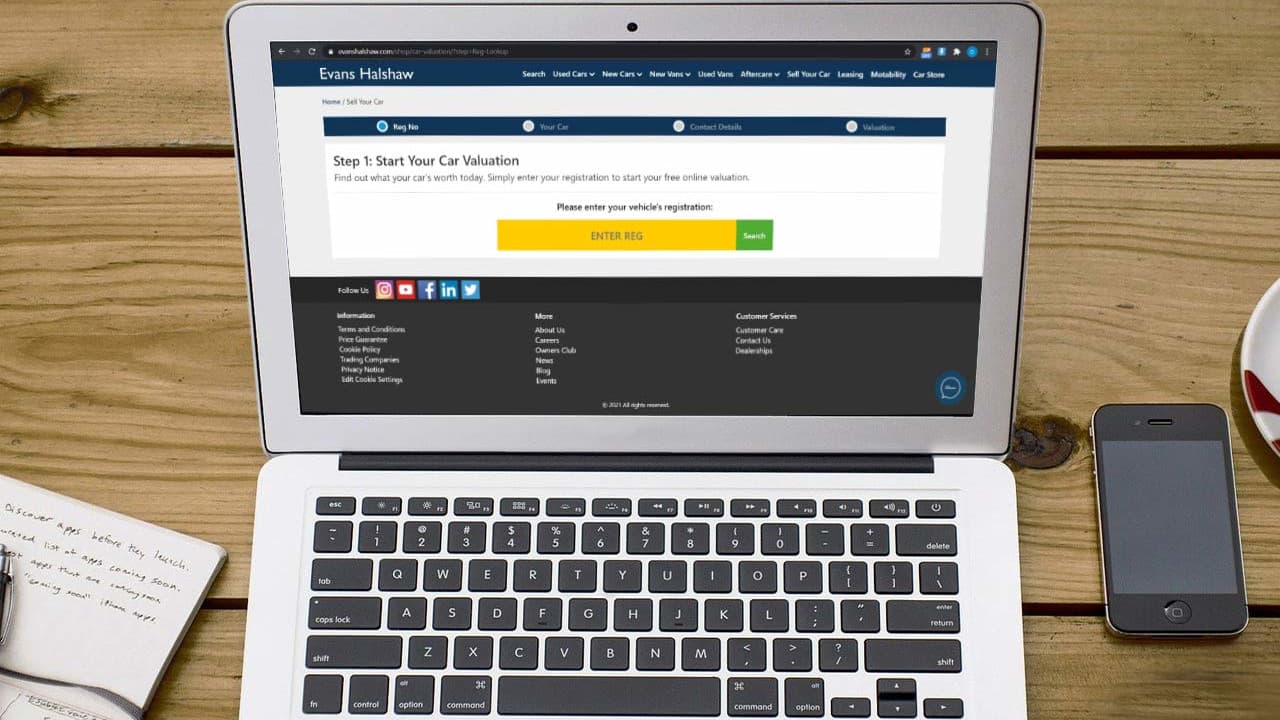

Step two: get your car valued

Then your car needs valuing which is super simple with our Sell Your Car tool. All you need to do is enter your registration number and a few extra details to receive a valuation price in minutes.

Step three: work out your equity

Next, time for a tiny bit of maths, subtract the settlement figure from your car’s valuation price. This will equal the amount of equity available in your car. If you have a positive figure, great news! You can use this amount of money as a part exchange for your next car. However, if the figure is negative, you’ll need to pay that amount of money on top of your new car’s price. So it’s still possible to swap your car but being in negative equity can make the swap costly.

Step four: check your Direct Debit date

See more : Does Car Finance Improve Credit Score

Finally, if you’re paying for your current car finance by Direct Debit, it’s a good idea to check what date your payments are made as your settlement figure will continue to reduce each time you make a monthly payment.

Interested in upgrading your car but unsure whether to get a car on a PCP or HP agreement? Let’s take a look at both finance options…

Personal Contract Purchase (PCP)

Personal Contract Purchase is a flexible finance option where a chunk of the payment is deferred until the end of the finance agreement. Due to the deferred payment, the monthly repayments (usually paid between 12 and 48 months) are often lower than HP agreements.

At the end of your contract you will have three options:

- Return the car – be prepared for charges due to unreasonable damage to the car or if you have exceeded your agreed annual mileage limit

- Purchase the car by paying the optional purchase payment (also known as a ‘balloon payment’ or ‘Guaranteed Minimum Future Value’) and any option to purchase fees set at the start of your agreement

- Part exchange the car for a new one and take out a new finance agreement

Hire Purchase (HP)

See more : Can You Finance A Car For 8 Years

Hire Purchase is an attractive finance option, especially if you know you definitely would like to own your car at the end of the finance agreement. The finance term typically lasts between 12 and 60 months where you’ll pay monthly payments until you have covered the total cost of the car and therefore, at the end of the agreement, own the car.

At the beginning of the contract you’ll pay an initial deposit which secures the car, this deposit will impact the amount you need to pay each month – the higher the deposit, the lower the monthly repayments.

A huge advantage of HP over PCP finance is that you won’t need to worry about additional charges at the end of the finance term for wear and tear or going over a mileage limit.

It’s important to consider your personal and financial circumstances before entering a HP agreement as if you miss any of your monthly payments this can affect your credit rating, making it difficult to obtain credit in the future. If several payments are missed, the car may even be repossessed.

Find your next dream car at Evans Halshaw

So you’re in positive equity and you’ve decided on whether to upgrade your car through either a PCP or HP agreement, now it’s time to find your dream car.

At Evans Halshaw we have an extensive range of new and used cars for you to browse online or you can visit your nearest Evans Halshaw retailer.

Source: https://tholansonnha.com

Category: Finance